* Chinese companies have investment and operating agreements in at least 37 ports on the American continent.

** Experts warn that Chinese port companies could use this infrastructure for military purposes in a hypothetical conflict.

*** Another risk is the control of international trade, outside the decisions of states.

Expediente Público / WASHINGTON

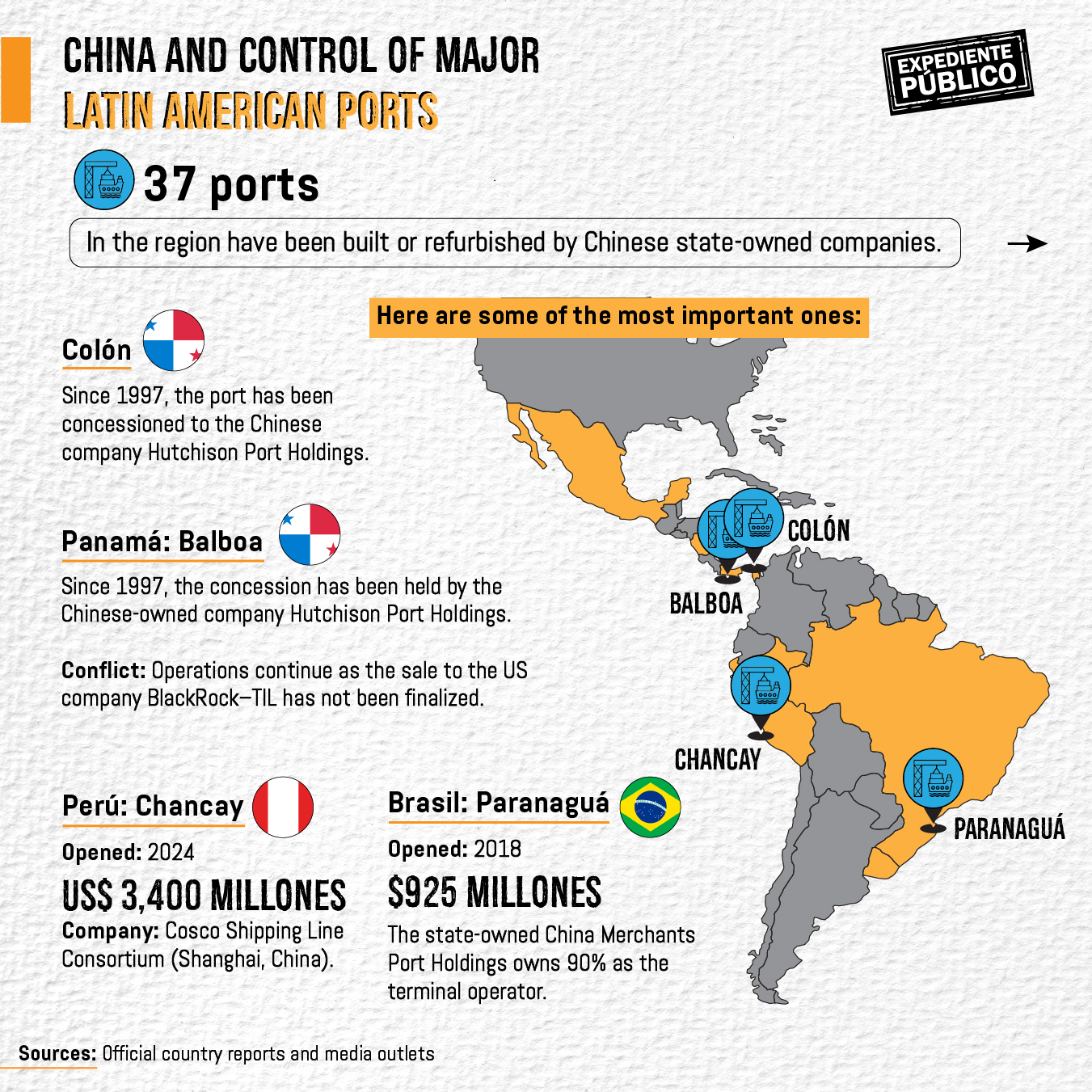

China controls a third of the deep-water ports in Latin America and the Caribbean. A study by the Center for Strategic and International Studies (CSIS) found that Chinese companies are the main investors or administrators of at least 37 ports out of 118 in the region, according to the Economic Commission for Latin America and the Caribbean (ECLAC).

The names of Chinese-owned companies, such as Cosco Shipping Company, China Merchants Port Holdings, and Hutchinson Port Holdings, are becoming increasingly familiar with the investment jargon of port systems in the Americas.

China has a greater presence in Brazil, where it controls eleven ports and investment in infrastructure has been increasing since 2018. Mexico follows, with four ports under Chinese control.

Subscribe to the Public Record newsletter and receive more information

Mexican and Caribbean ports, such as Kingston in Jamaica, are considered strategic due to their proximity to the US in the event of a hypothetical military conflict.

In addition, port control is key to the development of international trade. This gives China the power to influence the restructuring of trade relations between nations.

The CSIS warned in a report titled «No Safe Harbor: Assessing the Risk of China’s Port Projects in Latin America and the Caribbean,» published in June of this year, that this level of influence by the Asian power raises concerns.

«Gaining influence over strategic ports could provide China with crucial advantages, even before a formal military presence. Control or participation in port operations can facilitate the collection of intelligence on the naval movements of the US and its allies, privileged access to maritime logistics data, and the ability to deny or delay access during a crisis,» the research warns.

Henry Ziemer, an expert in Global Affairs and History at Yale University and one of the authors of the report, spoke with Expediente Público in Washington. For him, China’s expansionist strategy—through port control—has very direct objectives.

«It is a more intentional effort to confront U.S. interests in its own hemisphere,» Ziemer says.

He identifies three phases of Chinese penetration in the region. The first, known as «going out,» was implemented between 2002 and 2012 when the government encouraged Chinese companies to invest abroad. Then, China focused on critical infrastructure in the region. And the last, which is currently underway, with China measuring its strength against the U.S. to control the Western Hemisphere.

Latin America, between two powers

Ziemer argues that the Asian power is adjusting its expansion policy in response to the US, its main geopolitical adversary, with whom it is vying for spheres of influence.

The expert warns that Latin American countries do not want to be drawn into this struggle between the two powers, especially since they see the option of maintaining strategic, commercial, and diplomatic relations with both China and the US.

«I think that Latin American countries do not want a confrontation with the US,» says Ziemer.

Brazil, a key ally of China

A special case in Ziemer’s analysis is Brazil. The Trump administration imposed trade tariffs on the country up to 50%. For the specialist, a decision by President Luiz Inácio Lula could distance him from US influence.

Brazil is the country in the region with the most ports controlled by Chinese companies, with eleven ports. Among these, Paranaguá stands out as the deepest port and the focus of new investments by the Asian power.

Also: China Index exposes Beijing’s network in Latin America

CSIS researchers conclude that Brazil is emerging as a key ally of the Asian power on the American continent. Brazil is the only Latin American country in the BRICS club, along with Russia, India, China, South Africa, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates.

A report by financial analysis firm Fitch Ratings on Brazil’s port operations indicates that China continues to be in a privileged position. China Merchants Port Holdings secured a 90% stake in the Port of Paranaguá operations by investing approximately US$925 million.

And relations continue to strengthen. In May of this year, China’s Deputy Minister of Transport, Wang Gang, toured Paranaguá and other Brazilian ports and announced that the Asian country’s investments in the port sector would be expanded, according to Brazilian media reports.

Automation as a spearhead

For Evan Ellis, professor at the Institute for Strategic Studies, U.S. Army War College, Chinese control of ports is possible, in part, because of the efficiency of Chinese port companies.

«The Chinese are investing heavily in automation and also have a lot of yard space, and this combination also increases speed and lowers costs,» he says.

Port automation involves the use of new technologies such as robotic systems, data processing with artificial intelligence, the use of sensors in management processes, and the optimization of loading, unloading, and storage processes.

Possible military use of ports

Ellis also points out that China, while stepping up its commercial activity, is interested in positioning itself at «strategic» points that represent a vulnerability to the US.

The expert says that, during a military conflict, Chinese companies that control ports in the region could put this infrastructure at the service of the Chinese state for military purposes.

For this reason, Ellis stresses, China’s presence in the operations of the Mexican ports of Manzanillo, Lázaro Cárdenas, and Ensenada is cause for concern. These are points of direct access to U.S. territory.

There is also concern about the Jamaican port of Kingston, the seventh largest in the world, which is operated by Chinese companies.

However, CSIS report notes: «In the short term, it is unlikely that Beijing will openly establish naval facilities so close to the US mainland, given the risk of retaliation by Washington.»

Trade, beyond military risk

The CSIS report considers that Chinese advances in Latin American ports are risky because countries in the region lose their ability to maneuver in international trade.

It is also risky because the Chinese government gains more direct influence over these nations. CSIS argues that the lines between Chinese companies and the Chinese state are blurred, as all economic activity is subject to the interests of the Chinese Communist Party.

In addition: China threatens and extorts to impose its agenda on the world’s media

However, it does emphasize that the «beyond the military risk,» control of ports also gives Chinese companies influence over key nodes in regional supply chains, reinforcing Beijing’s economic and diplomatic influence in Latin America and the Caribbean.

Over time, these infrastructures could be critical to «restructuring trade relations and consolidating economic alliances,» adds CSIS.

Panama and Nicaragua

Panama gained notoriety this year when it became the target of criticism from U.S. President Donald Trump, who promised during his inauguration that he would take back the canal to prevent Chinese presence.

However, Chinese companies continue to control the infrastructure of two ports, Balboa and Colón, the former on the Pacific and the latter on the Atlantic, considered the gateways to and from the canal.

Of interest: China Index: Chinese influence in Panama goes beyond the canal

In addition, Chinese influence is advancing along the Central American coast. In July, the Nicaraguan dictatorship granted China Iconic Technology Company Limited permits to develop the port of Corinto with an estimated investment of $128.5 million, while Nicaragua would only pay $22.4 million, according to the ratified agreement.

Peru and its alliance

For Ellis, ports reveal China’s level of strategic interest, such as the Chancay port in Peru, inaugurated in November 2024, a mega-infrastructure valued at $3.4 billion and located about 70 kilometers from Lima.

The port’s complex consists of 15 docks, office buildings, logistics services, and a two-kilometer-long tunnel for cargo exits to the shipping area, making it a large-scale port.

Chinese President Xi Jinping traveled to Peru to kick off the mega-structure.

The Chinese leader predicted that with this port, Peru will consolidate its «status as a hub that links land and sea transport and connects Asia with Latin America and the Caribbean.»

You may be interested in: China challenges US hegemony in Latin America

At the inauguration of the mega-infrastructure, Peruvian President Dina Boluarte said that the project «reflects how Chinese investment and mutual cooperation can be engines of sustainable development and progress for our nations.»

Risk or paranoia?

In response to the CSIS study, China Xinhua News published an article by analyst Zichen Wang, who pointed out that the report is based on assumptions and shows clear «paranoia» about China’s trade relations with Latin American countries.

According to Wang, CSIS is based on «hypothetical threat scenarios and vague assertions about economic risks.»

Read: China puts democracy in Latin America to the test

The analyst criticizes the report’s authors for labeling Mexican and Jamaican ports as high risk solely because of their geographical location.

«Many of the report’s conclusions are based on weak evidence and assumptions that deserve careful scrutiny,» Wang says.

He argues that CSIS does not consider the autonomy of Latin American governments. According to Wang, it is unlikely that China would use ports in the region for military activities in hypothetical conflicts.

What Wang does accept is that «large infrastructure investments can increase a country’s economic dependence on China.»

However, he stresses the viewpoint that the participation of Chinese companies in Latin American ports is part of economic dynamics where «ports are competitive environments and operators (including Chinese state-owned companies) are often profit-driven, seeking to maximize returns rather than selectively restricting supply lines.»