*Financial persecution is transnationalized through the regional financial system.

**Dozens of accounts of opponents and organizations have been closed in Costa Rica.

***The regime uses Nicaragua’s private banks to prevent organizations from accessing funds through lists of banned clients shared with subsidiaries, branches, and intermediaries abroad.

Expediente Público

The freezing and closure of accounts, the cancellation of credit cards, certificates of deposit and insurance policies, as a measure of repression against natural and legal persons that the Ortega Murillo regime considers opponents, has reached Costa Rica.

The first affected exiles pointed to the Nicaraguan private banks with a presence in Costa Rica: BAC, Lafise Bancentro and Banpro Promerica, but one later testimony include include the state-owned Banco Nacional as part of these practices of financial harrassed against Nicaraguan opponents and organizations persecuted by the Ortega-Murillo regime.

Subscribe to the Expediente Público newsletter and receive more information

In addition, it is not ruled out that this repressive measure will continue to reach other countries where persecuted Nicaraguans have settled, since, to export this practice, Daniel Ortega uses the current legal framework to prevent money laundering, according to several sources consulted by Expediente Público.

According to Gonzalo Vila, director for Latin America at the Association of Certified Financial Crime Specialists (ACFCS), due to the gaps in the legal framework against money laundering, banks can promote practices at their discretion.

After reviewing some notifications that the entities sent to those affected, Vila assures that there is no specific accusation against them, so the banks are using a “very wide discretion” to act.

Expediente Público had access to these notifications, but for the protection of the exiles and their families, it omits to present them or delve into details.

The Power of the Bankers

“Regardless of whether there may be some kind of political intent, some kind of political link with the decision (to suspend financial services), it is the bank’s discretion,” the specialist reiterated.

Vila cannot answer whether the banks are acting in bad faith or complicity, they are simply protected by the legal framework of financial institutions.

“From what I see here, (they are protected) by regulation, norms and legislation. It remains to be seen if (the banks) can give some kind of bigger and broader explanation,” he said.

Expediente Público asked the entities in charge of supervising the Costa Rican financial system why banks are applying this measure and what those affected can do to appeal these decisions.

The Press Office of the General Superintendence of Financial Institutions (Sugef) responded that this entity has no interference in the policies of each financial institution to determine the type of customers to whom it offers its products.

However, banks have sustained a repressive practice in the current legal framework for the prevention of money laundering, regardless of the real motivation behind these actions. Daniel Ortega uses the entire state apparatus to persecute opponents, Vila explained.

It should be remembered that many of those affected, such as a well-known diplomat who only found out that his funds were intercepted, because he could not make a withdrawal, and hundreds of NGOs and political and social leaders, the banks did not send them any notification about the freezing or cancellation of accounts.

For the journalists, administrative employees of media outlets and cancelled NGOs who have been notified of the measure, they only mention Resolution CD-SIBOIF-524-1-MAR5-2008 and Law 977 Against Money Laundering and when further explanations are requested, the answer is that they are internal policies of the institution, it is not even known if that pattern applies to people involved in that crime.

Militarized control of the financial system

The United Nations (UN) Group of Experts on Human Rights on Nicaragua (GHREN), in its second report presented at the beginning of March, specified that “Ortega and Vice President Murillo have control over all the other powers and institutions of the State.”

The group identified that the Ortega-Murillo family gives orders and instructions – directly or through trusted advisors – “to the different institutions that have to carry out repressive acts against opponents or perceived as such and their families.”

In the case of the freezing and closure of accounts and certificates of deposit, and the cancellation of credit cards and insurance policies, the Judiciary or the regulatory body of the sector, the Superintendency of Banks and Other Financial Institutions (SIBOIF) extends the control to the banks, a former bank official told Expediente Público.

The Judiciary and the Siboif issue the orders and the entities of the banking system limit themselves to complying.

In context: Nicaraguan Regime Will Access Bank Information Without Users Knowing

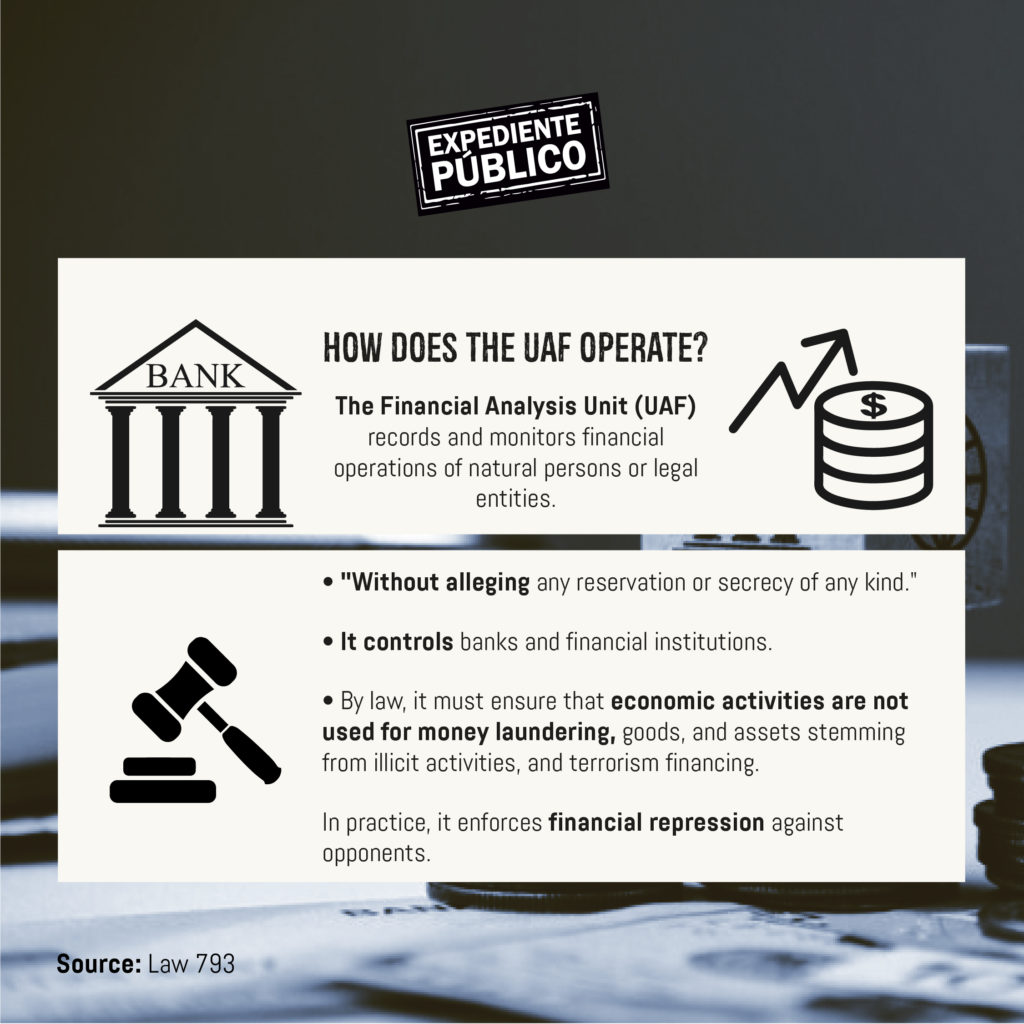

According to Law 976, Law of the Financial Analysis Unit (UAF, Unidad de Análisis Financiero) approved in July 2018, one of the functions of this entity is to collect information on money laundering, process it and analyze it to transform it “into a product that serves as an input to the corresponding authorities in the process of investigation and subsequent criminal prosecution of crimes.”

These investigations are being carried out by the Directorate of Economic Research, which since January 2023 has been headed by Commissioner General Sergio Gutiérrez Espinoza.

Therefore, the information on which the Public Prosecutor’s Office bases the accusations related to money laundering comes from the UAF. Then, the order to close, freeze or cancel some financial service comes from any of these institutions and the banks carry out the measure.

The UAF is led by a retired military officer, Major General Denis Membreño Rivas, and the deputy directorate is occupied by a policeman, Commissioner General Aldo Sáenz Ulloa.

“They have to obey their regulator (SIBOIF) because if they don’t, they are fined and can even go bankrupt, then the bank obeys and closes the account,»” explained the former bank official who for fear of reprisals avoids identifying himself.

“What is going on here? The problem is not the banks; here the problem is that the government is a government that is totally out of all legality, that applies the law in a totally arbitrary way,” said the former bank official.

“If the regulator tells the bank that such a person is a terrorist or is laundering money and can’t have an account, then the bank has to close it,” he said.

How the Repressive Tentacle Arrived in Costa Rica

In recent months, a segment of exiles and organizations made up of Nicaraguans trained and registered in Costa Rica, whose accounts were closed or refused to be opened by the BAC Costa Rica, Lafise Bancentro, Banpro Promerica and the state-owned Banco Nacional, began to grow.

But the former financial executive assures that Nicaragua does not have the power to force any bank with affiliates or subsidiaries in other countries to close, freeze or cancel products or services to Nicaraguans, natural or legal, established in Costa Rica or other countries.

Therefore, it advises reviewing the current legal framework and exhausting the established channels for filing a complaint.

However, the former executive explained to Expediente Público that it is a mandatory practice throughout the world, that every year banks draw up their “blacklist” of customers, which includes those who recurrently use bad checks, do not pay loans, do not deliver guarantees, have been convicted of money laundering and other crimes.

The list includes those sanctioned by the U.S. Treasury Department, or who engage in other types of transactions considered high-risk. Entering these lists makes them unsuitable to have relations with entities in the financial system.

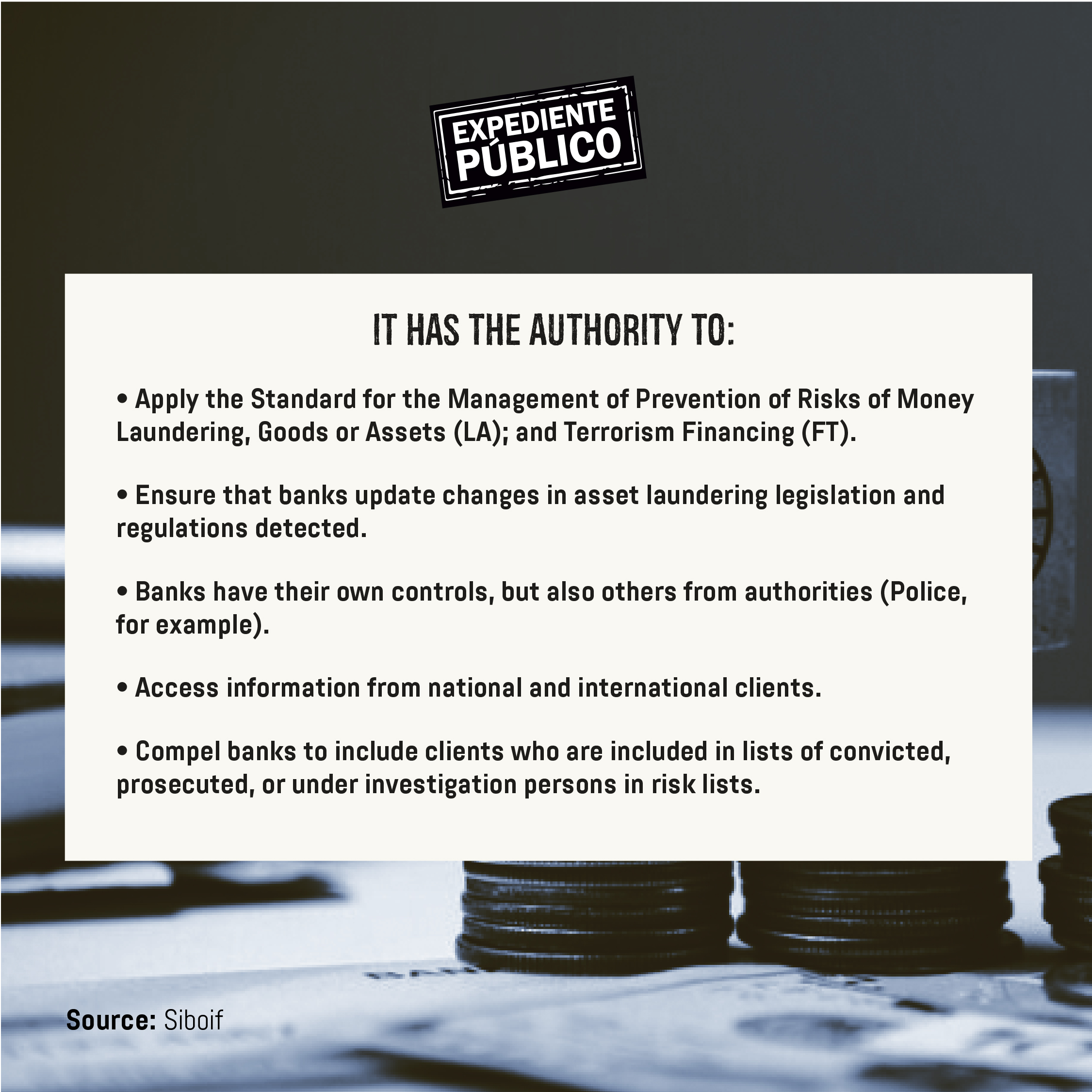

In fact, the Standard for the Management of the Prevention of the Risks of Laundering of Money, Goods or Assets; and the Financing of Terrorism (AML/CFT Standard) of the Siboif, establishes:

“Where applicable, the Supervised Entities must implement the Comprehensive System for the Prevention and Management of the Risk of Laundering of Money, Goods or Assets (SIPAR) ML/CFT at the level of the Financial Group incorporated in Nicaragua, including all its branches, subsidiaries and representative offices abroad.”

In addition, it clarifies that “if the legal, regulatory, normative and practical requirements for the prevention of ML/CFT in other countries where a member of the Financial Group operates differ from those established in Nicaragua, the member of said Group must apply the measures that are strictest among the different jurisdictions in accordance with international standards.”

“And likewise, when in another country the application of the SIPAR ML/CFT is prohibited or prevented, such situation must be communicated without delay to the parent company and the Superintendence, and be in accordance with local law,” the regulation says.

Also Read: Daniel Ortega empowers the military to supervise Nicaragua’s banks

In addition, according to the former bank official, all Nicaraguan banks consolidate their operations into holding companies established in Panama; this forces them to submit to the regulations of the Superintendence of Banks of Panama.

As part of this supervision, they must hand over their blacklists, and these become regional and the natural or legal persons included in them are banned from all banks in the region.

Despite this, the former bank executive maintained that the repressive practice that Ortega exported to Costa Rica is a violation of the human rights of those affected.

What else does Sugef say?

Sugef explained to Expediente Público that “the National Council for the Supervision of the Financial System (Conassif) has not issued any regulation that directs financial institutions to close accounts to certain types of customers, so this obeys a decision of each entity, adopted based on its risk appetite and internal policies.”

Despite this discretion, the Superintendency admitted that “the closures of accounts cannot be arbitrary, in accordance with the provisions of Article 27 of the Prevention Regulations, SUGEF Agreement 12-21.”

This agreement provides that “the obligated entities must implement policies and procedures to communicate in a motivated manner to the clients, the reasons why it has been decided not to establish or terminate the commercial relationship.”

The entity also explained that “on some occasions when there have been arbitrary closures with a client, regardless of their nationality, they have gone to the Fourth Chamber (Constitutional Chamber of the Supreme Court), since Sugef does not have the power to rule on the matter.”

Sugef is a state agency that, among other functions, supervises the operations and activities of the entities of the Costa Rican Financial System and to ensure their stability, soundness, and efficient functioning.

Only one bank responded

On February 27, Expediente Público sent emails to BAC Nicaragua, Banpro, BDF, and Lafise Bancentro, as well as the subsidiaries of BAC, Grupo Promerica, and Lafise in Costa Rica, requesting interviews with their officials or at least an explanation regarding this measure. Additionally, on March 4, attempts were made to reach the public relations officers of the mentioned Nicaraguan banks by phone to reiterate the request, and in the case of BAC, also to the public relations agency working with them, but in none of the cases was a response obtained.

Furthermore, on April 10, an email was sent to the press department of the state-owned Banco Nacional (BN) of Costa Rica, which has joined in this repressive practice against Nicaraguan opponents, with at least one verified case. Of all those consulted, it was the only one that responded.

The Institutional Relations, Reputation, and Communication department of BN declined to comment on those affected by the account closures, citing Articles 24 of the Political Constitution and 615 of the Commercial Code, which establish that the information of bank customers, including their personal information and information related to their financial services and products, is protected by banking secrecy and cannot be provided to third parties.

Regarding the account closures, they stated that «in accordance with Article 616 of the Commercial Code, a bank account can only be closed by the will of the parties, either the account holder or the bank, to which it must be added that closure also occurs when ordered by any judicial or administrative authority in our country with competence in the matter.»

For his part, Danilo Montero, executive director of Costa Rica’s Financial Consumer Comptroller’s Office (OCF), agreed with Sugef that banks have full power to choose their customers.

However, it also insists that banks are obligated to give an explanation that satisfies those affected about the reason for the cancellation or refusal to offer products, regardless of their nationality.

In other words, unlike what happens in Nicaragua, where in some cases they have limited themselves to saying that they are internal decisions of the bank, in Costa Rica, they are obliged to give all the necessary explanations to the affected party.

According to Montero, there are no official statistics on the number of people who are denied account openings and other banking services. However, he believes that, although some cases are recorded, it is not a common practice. And it advises those affected to exhaust the established mechanisms to assert their right.

In addition: Gisela Sánchez assumes CABEI presidency amid scandal over Costa Rica funds

He points out that in each entity there is a comptroller of services that is the first instance where an explanation can be demanded, but if the answer is not satisfactory, the affected person must go to the Financial Consumer Office (OCF).

The OCF will receive a response in about a month; if it is in favor of the customer, the bank must comply with the resolution, and if it is against it and the affected party is not satisfied, they must transfer the complaint to the Constitutional Chamber, popularly known as the Fourth Chamber, and demand their right to defense.

Montero explains that the OCF can only intervene in cases involving private banks. Therefore, if the complaint is against a state-owned bank, the affected party must go directly to the courts of Justice or directly to the Constitutional Chamber.

Montero insists that all those affected by Costa Rican banks must exhaust the legal avenue, where cases similar to those faced by Nicaraguan individuals and legal entities, who are being affected by these closures, have already been resolved.

The Office of the Financial Consumer (OCF) is a private self-regulatory body that works within the framework of an agreement with affiliated financial institutions. Its main objective is to respond to queries and complaints related to financial products and services and to promote financial education.

Banking: extorted or collaborator?

In the opinion of the former bank official consulted, Nicaragua’s financial institutions have only two options in the current context, obey the orders that emanate from the regulatory body or the Judiciary; or not abide by the order and abide by the consequences that imply that the State will use all its institutions against them, impose fines and even lead them to bankruptcy.

“No banker is going to risk that. (But) not only do I believe it, I’m sure the banks are not cooperating with the government. It is not that on their own initiative they are closing accounts of all those people who are opponents, who are exiled or imprisoned or tried for spurious crimes,” he added.

“This is another violation of human rights, but banks have no choice but to comply with the instructions given to them by their regulator,” insists the former banking executive.

The former official also explains that, although banks in some cases have notified their customers of the decision to suspend accounts, they are not required to do so.

Defenseless Nicaraguans

In addition, it details that, for people with lawsuits, the Judiciary ordered to freeze their accounts. In the case of the 222 former political prisoners who on February 9, 2023, were exiled to the United States and then stripped of their nationality and confiscated of their assets, after banishing them, Sandinista judges ordered the banks to transfer the resources from their accounts to a state account.

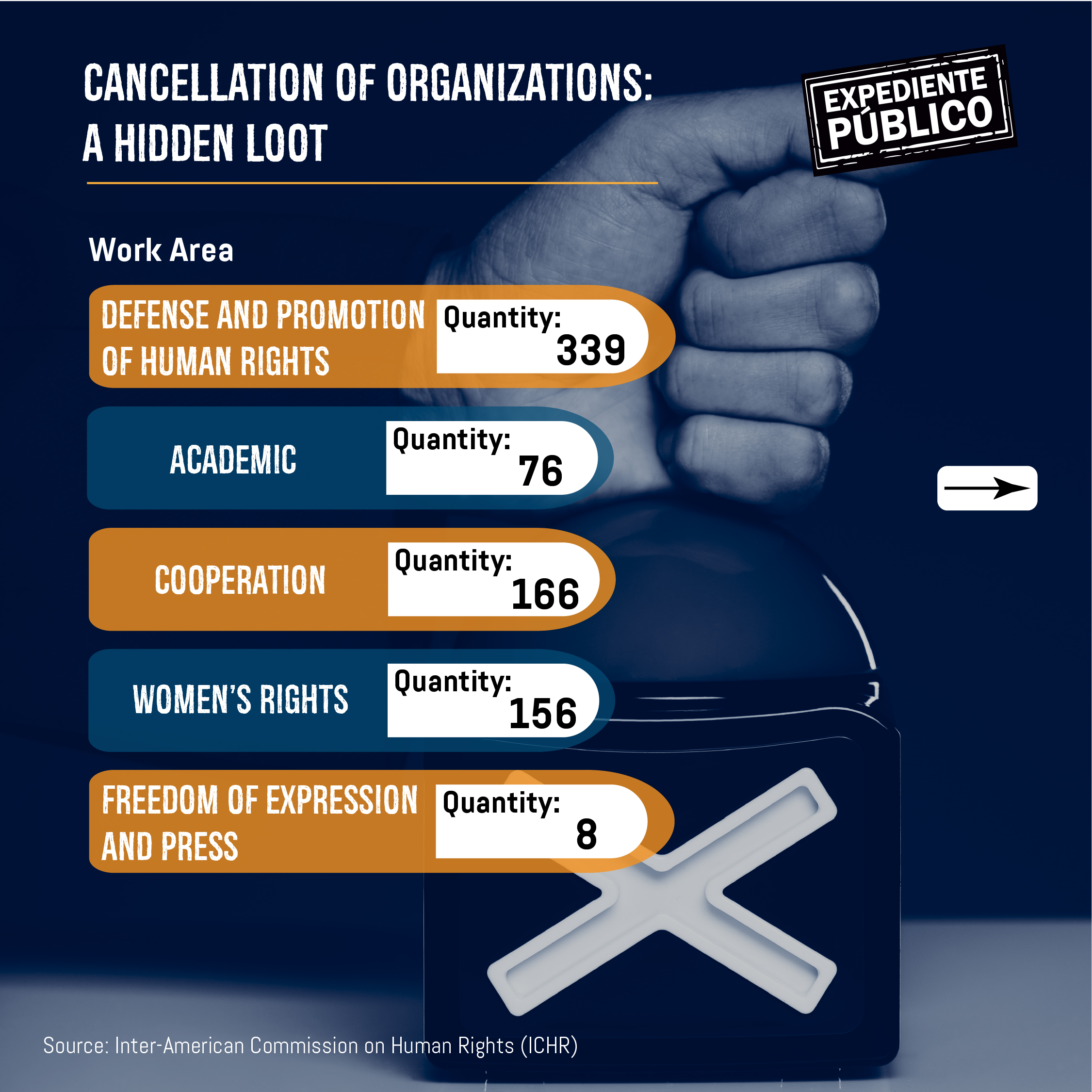

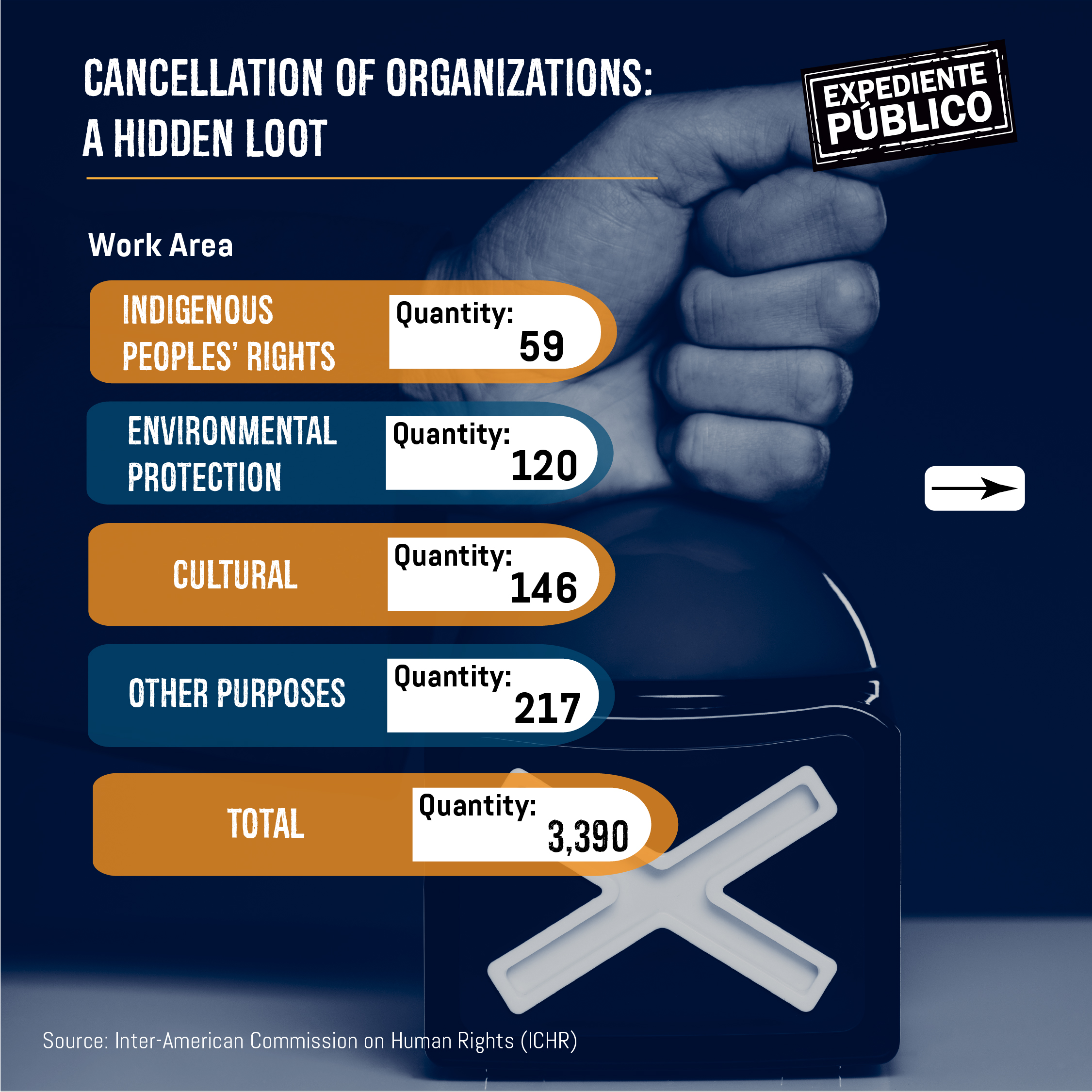

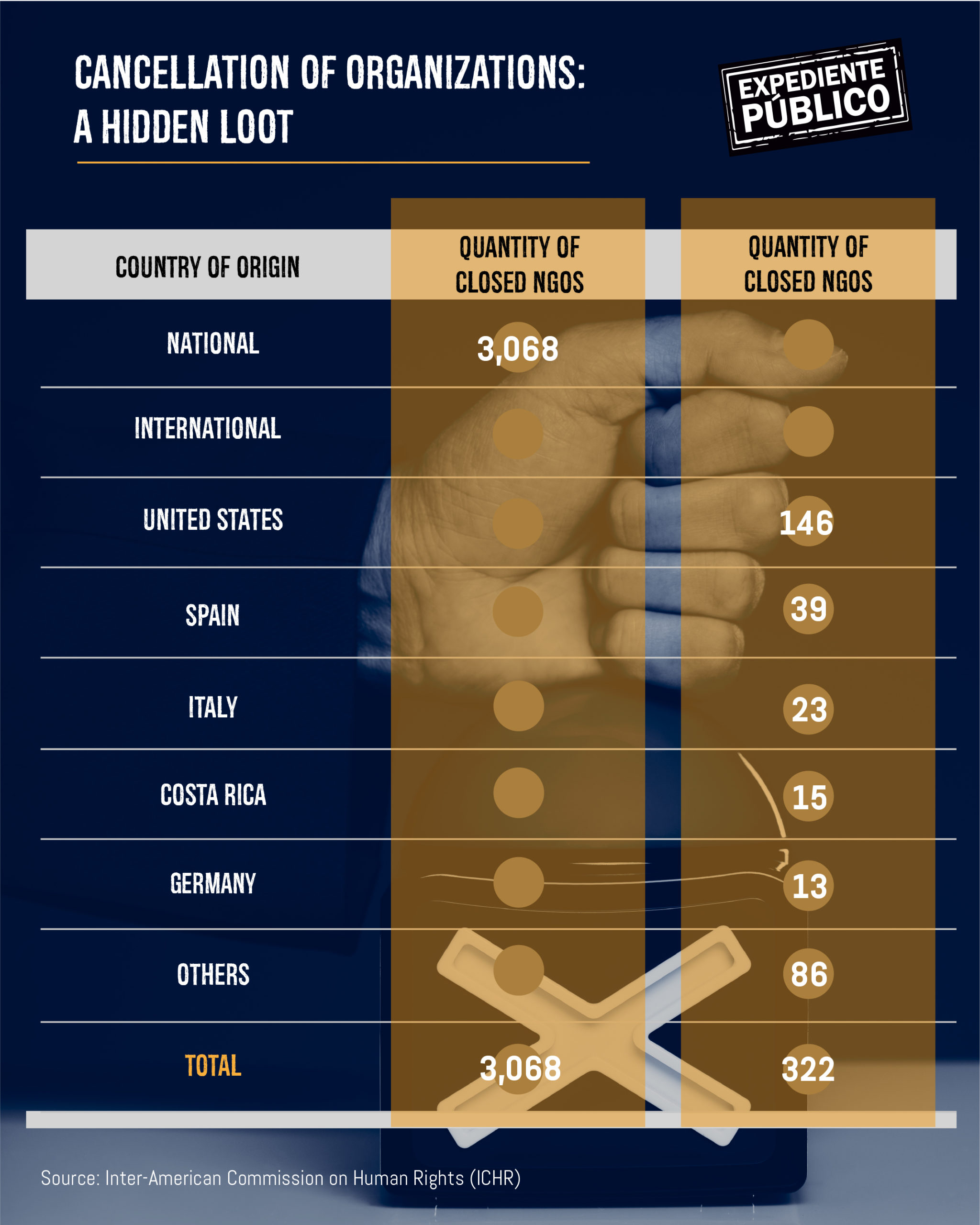

Something similar happens with the almost four thousand NGOs that have had their legal status cancelled and their assets confiscated. Initially, their accounts were frozen on the instructions of the Ministry of Governorship, now the Ministry of the Interior.

In some very specific cases, they were allowed to withdraw their resources, but the vast majority had their accounts frozen until the regime authorized their transfer to the State.

There is another group of journalists, human rights defenders, activists, officials of closed NGOs and other Nicaraguans who were notified by the banks of the cancellation of the products they were offered and gave them a deadline to withdraw the money they had available.

In the same way, it informed them from what date their insurance policies and other services became inactive.

Curiously, although in many cases they are organizations or individuals accused of money laundering, the loans they have with the banks are still in force, including mortgage loans that have properties that the regime confiscated as collateral.

Despite being high-risk customers and being on the so-called blacklists of banks, that debt relationship is still in force, according to the former bank executive, because they received resources from the bank that they must pay and not doing so will damage their credit history.